WallStreetZen shines when it comes to providing simple and intuitive analysis. Each of the stocks has a Zen score that determines and rates each company based on these factors. policy

Comparison

Performance

Separation

money

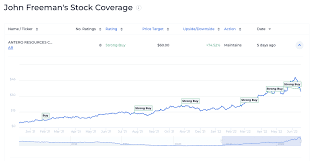

As you can see above, AAPL’s stock is currently low. In fact, the stock price has performed amazingly over the past year, making its base higher. This is also where you will find high marks for performance.

Each page links to articles that refer to the company. This will allow you to read current events and news that may affect the company’s stock price.

The good thing about WallStreetZen is that it’s free. So it’s a great addition to your and every investor’s research collection.

Objective analysis without hidden objectives

WallStreetZen’s financial model uses no hidden agenda or personal bias. They provide the same quantitative analysis for each listed product.

Automated monitoring works for you

The great thing is that you don’t have to model DCF and build a spreadsheet to track changes. WallStreetZen works automatically with the latest financial data. Then it gives you all the important results in a simple, one-line description. Only the essentials

Instead of cramming each page until it’s overloaded with data, they choose important metrics that every investor should focus on. Additionally, they help you visualize the company and historical context behind each publication.

Minimalist, clean and beautiful

WallStreetZen cares about providing an exceptional user experience to everyone. So they made things clean, beautiful, small, and friendly. It’s perfect for investors who don’t go into the messy space that most traders find. Also, WallStreetZen also does this for stock reviews and review websites. Compared to many stock research sites that are overcrowded and overloaded with data, WallStreetZen takes a minimalist approach. Everything is simple and clear, allowing you to focus on all the data you need to make great financial decisions. WallStreetZen Analysis: Limits

It’s hard to beat free work. All I can think of is to note that WallStreetZen is in beta mode. Things can change if you are used in a specific way.

But all its distinctive features and focus on user experience make it the most relevant and trusted product search site. It’s better for investors who want to research products with less noise and more insight.

Is WallStreetZen for you? If you are new to fundamental analysis, you can take advantage of WallStreetZen to guide and train you. It’s a great way to learn by doing a critical analysis process. Overall, this is a great free resource for new entrepreneurs who don’t want to review annual reports or financial statements. Charts and tables are well organized and easy to read. Product review is basic, but very functional.

Experienced investors who use data and detailed information will look elsewhere. Services like Stock Rover or Finbox are great options for those who want a deeper experience.